The forecasting crowd creates great opportunities for others

In last month’s commentary we covered the futility of trying to forecast financial markets and noted the following;

“From our experience, trying to predict market direction or whether interest rates are going up or down is not a reliable source of returns … which is why we don’t bother.

Instead we focus on relative value opportunities arising from market inefficiency, which have a high probability of positive returns, irrespective of the future direction of markets.

Sometimes these opportunities arise precisely because market participants, emboldened by a strong consensus of expert forecasts, cause pricing in a particular segment of the market to become highly skewed in one direction, at the expense of severely under-pricing all the other possible scenarios that could play out.”

Just such an opportunity has played out in Australian interest rate markets over the past two months.

Throughout most of 2018 the RBA consistently guided that the next move in interest rates would be up and as of mid-2018, the 30 or so expert economists tracked by Bloomberg had a median forecast for the RBA to hike rates to 2.0% by the end of 2019. These are the experts whose full time job is to scrutinise the Australian economy.

The highest forecast was for a hike to 3.0% and the lowest was for the rate to remain unchanged at 1.5%. Nobody was forecasting rate cuts and this was also reflected in market pricing.

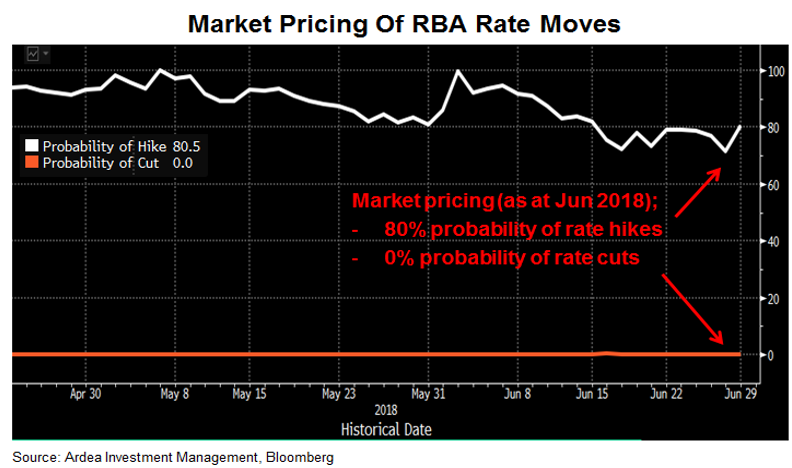

The chart below shows the probability of interest rate moves derived from pricing in the overnight index swap (OIS) market. As of June 2018, market pricing implied no chance of a rate cut by the end of 2019.

At that time we noted this highly skewed pricing presented a good opportunity to position around the growing risks to the Australian economy from China’s slowdown and domestic housing weakness. (Refer – Australian rate hike expectations collapse)

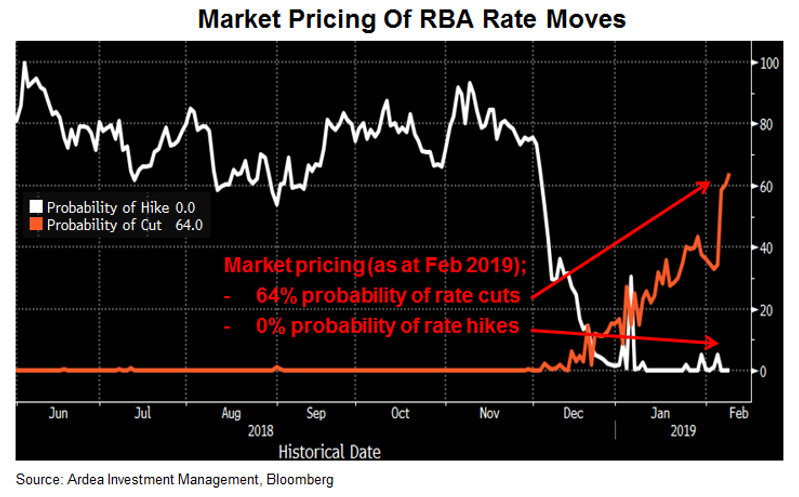

Over the past month the picture dramatically changed. The median expert rate forecast for Dec-2019 has now dropped to 1.5%, and the lowest forecast predicts a rate cut to 1.0%.

Market pricing has also shifted accordingly, as shown below. This shift delivered significant profits to option positions that were very cheap to enter back in mid-2018.

The point here is not about predicting the direction of rates – in our view no one can reliably do that – but rather to look for favourably asymmetric opportunities (i.e. limited downside vs. disproportionately large upside) that take advantage of markets under-pricing future uncertainty.

These opportunities often arise when the forecasting crowd gets too skewed in one direction. For example, when you start hearing experts say things like “… there’s no way the RBA can cut rates”, that’s usually a good signal to start looking for asymmetric opportunities to take the opposite side of the overconfident forecasters.