Record inflows to bonds despite record low yields

Despite bond yields in many markets getting vanishingly low, inflows to bond funds globally have actually accelerated this year.

For example, data provider EPFR recorded $17.5bn of inflows to bond funds for the first week of June, making it the 2nd largest weekly inflow on record. The majority of this went into government and investment grade corporate bonds.

Why have bonds become so popular despite offering such low yields?

As the chart below from Deutsche Bank shows, bonds appear to be benefitting from a ‘safe haven’ rotation out of equities. With the memory of Q4 2018’s equity drawdown still fresh and trade war headlines dominating the financial media, investors appear to be seeking the perceived safety of bonds.

What has also supported bond inflows is the overwhelming consensus view that central banks globally have now shifted to rate cutting mode.

However, what seems to be ignored is the asymmetry inherent in bond return profiles and the implication that low yields have for the defensive characteristics of bonds.

Tackling the asymmetry first, unlike with equities, the upside potential in bonds is inherently capped.

Even if stocks are expensive, there is no real limit to how high they can go. Bond prices on the other hand are bounded by the fact that returns are limited to interest payments received over the life of the bond.

Over shorter time horizons, bond prices fluctuate as interest rates / bond yields move around and this can be an additional source of capital gains or losses, with the relationship between bond prices and yields being an inverse one (i.e. lower bond yields = higher bond prices).

This is where the asymmetry comes in.

Bond prices can’t keep going higher unless yields keep going lower, but when the starting point of yields is already very low to begin with, there is naturally less room for them to drop further.

As the experience of Japan and Europe shows, there is strong resistance to bond yields going far below zero, because a long term investor buying bond with negative yields would be locking in a guaranteed loss.

Therefore as yields get very low, the return profile of a bond becomes unfavourably asymmetric i.e. it becomes increasingly difficult for yields to keep dropping / prices keep rising and easier for yields to rise back to more normal levels, with prices falling accordingly.

This asymmetry of risk vs. return is what makes chasing bonds at record low yields (i.e. record high prices) very different to chasing stocks at high valuations. Stocks can keep on going up indefinitely, while bonds can’t.

Turning to the defensive characteristics expected from bonds, what matters here is the ‘yield cushion’.

The stable income provided by bonds, together with the possibility of falling rates / bond yields delivering additional capital gains in adverse market environments combine to form the ‘yield cushion’. This is what gives bonds their defensive characteristics.

When bond yields are very low to begin with, yield cushions are small and bonds are inherently less defensive. (We covered this topic in detail here)

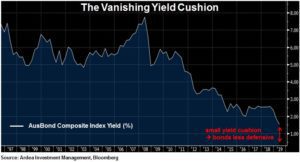

In Australia for instance, bond yields have declined dramatically over the past year, leaving yield cushions very skinny. As an example, the chart below shows the yield on a widely used index of AU govt. and investment grade corporate bonds.

This index has delivered an abnormally large return of 9.6% over the past year and even more unusual, this happened over a period in which equities have also rallied. (Usually, bonds only deliver such large gains when equities experience material losses.)

It’s important to remember that this gain and by extension the gains on bond funds that track indices like this one, was largely driven by the duration exposure (i.e. interest rate sensitivity) inherent in the bonds that make up this index. As interest rates and bond yields declined over the past year, the duration exposure resulted in large capital gains.

But of course this can just as easily go the other way, which is why the ubiquitous disclaimer that past performance is not indicative of future returns, has become particularly relevant for bond investors.

With the index yield having now collapsed to just 1.5%, which is barely above cash deposit rates, more caution is required about duration risk in the event of a reversal to more normal yield levels.

To put this duration risk in perspective, if yields revert even modestly to where they were as recently as December last year, the index would incur a capital loss of 5.5%. But to generate a gain of that magnitude the index yield would need to drop to an eye wateringly extreme level of just 0.5%.

This is the kind of asymmetry that conventional duration based AU bond investments are currently faced with and because of this, the lower that yields go the more vulnerable investors become to future losses.

Of course it’s possible that yields could drop that low but given the RBA has already delivered one rate cut, you need strong conviction in a very negative economic scenario playing out to expect further capital gains from holding onto duration exposure at current levels.

This also begs the question as to whether the record bond inflows seen this year are based on considered analysis of risk vs. return dynamics or whether they are simply driven by investors who are anchored to past performance.