Opportunities in Australian money markets

‘Money market’ is a term used to describe the segment of financial markets where large institutions can borrow or lend cash for short periods.

From an investor’s perspective, this is a market that provides various alternatives for earning a return from depositing short term cash. This is because the instruments used tend to be highly liquid and have very low default risk, just like a conventional cash deposit.

As such, money markets are usually the most boring segment of financial markets and are not the obvious hunting ground for market inefficiency that creates relative value mispricing (i.e. pricing differentials between instruments that have similar risk characteristics).

But in recent months, as a result of pressures in AUD funding markets (refer June 2018 commentary on Australian bank funding pressures), a number of attractive low-risk opportunities have arisen for investors with short term AUD cash to invest.

These have included the switch from 6-month funding to longer-dated funding by the major banks, the large increase in demand for short-term funding driving higher bank bill rates, and the increase in repo rates which has in turn pushed other cash rates higher.

The newest entrant in this area is the foreign exchange market, where shifts in market pricing have created attractive relative value opportunities in Australian interest rates, relative to those of the other major currencies.

These opportunities arise in a specific part of the foreign exchange market, namely in forward exchange rates. The forward exchange rate is the exchange rate for delivery of currencies at some future date, say in three months’ time. This is in contrast to the spot exchange rate, which is the exchange rate for transacting today, with delivery in two days’ time.

The difference between the spot and forward exchange rates represents the cost differential between delivering a currency in two days, compared to delivering in three months. Just like any other future cash flows, the time value of money applies: immediate cash flows have a higher present value than future ones, even just three months later.

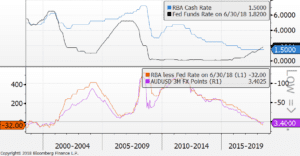

Because different currencies have different interest rates – that is, the RBA Target Cash Rate of 1.5% is currently below the Federal Reserve’s target for the Federal Funds Rate of 1.75%-2% – the difference between the spot and forward exchange rates, known as the forward points, will reflect this interest differential.

That’s how things are meant to work in normal market conditions, and that’s what students of finance mean when they say “covered interest parity”. We know this works over long periods of time, as the interest rate differential between say the US and Australia is tracked very closely by the forward points (Figure 1).

Figure 1: Australia US Cash Differential and FX Points

Source: Ardea Investment Management, Bloomberg

Today’s financial markets are very different however, and far from the textbook case studies of perfectly functioning efficient markets. This has meant that the forward points have diverged from what pure interest rate differentials would imply, creating a difference in funding rates.

This has arisen because of shifting flows in the foreign exchange forward market. Whether due to foreign investors seeking to purchase Australian financial assets, or perhaps for foreign direct investment, this has created strong demand to hedge Australian foreign exchange risk. This has resulted in more sellers of Australian dollars for forward delivery than buyers.

The resulting imbalance has meant that forward points have declined, and thus the implied interest rate from delivering Australian dollars today and receiving them back in three months’ time has surged well above other domestic interest rates, such as the rate earned on bank bills. The implied interest rate has also exceeded the repo rate earned on cash secured with government bond collateral.

In short, the FX forward market is currently paying you a lot more to deposit 3 month AUD cash than other money market alternatives, and this opportunity can be exploited without taking any FX risk.

In our view these developments are ultimately a positive for the market, as investors with the right expertise can now benefit from a greater pool of market participants who are all competing actively to pay attractive rates on short-term cash of various forms.