Markets Wake Up To Inflation Risk

As noted in prior commentaries, inflationary pressures have been building globally and particularly in the US. The rise in breakeven inflation rates over the past two months shows that markets have begun to price this in.

Breakeven rates are calculated as the difference in yield between nominal bonds and inflation linked bonds. For the former, the interest you earn is a fixed amount, while for the latter it is linked to actual inflation that materialises over the life of the bond, so that if inflation rises your interest income will also rise.

The breakeven rate represents market expectations of future inflation plus risk premia for the uncertainty associated with that expectation, and also the lower liquidity of inflation linked bonds.

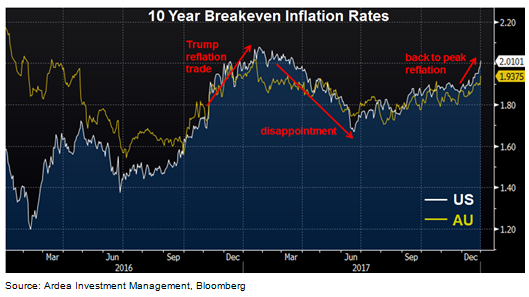

The chart below shows the evolution of US and AU 10 year breakevens over the past two years.

Following a period of declining inflation, breakevens spiked higher on President Trump’s election and his promises of pro-growth (and therefore inflationary) policies … the so-called Trump reflation trade.

However, those expectations turned out to be premature as inflation readings subsequently surprised to the downside and President Trump hit obstacles in delivering on his promises. Accordingly, breakevens retraced their earlier rally, hitting a trough in June.

From that point, economic data began to improve, inflation indicators gradually turned higher and President Trump got traction with his pro-growth policies. The most recent catalysts have been higher oil prices, progress on US tax reforms and signs of long absent wage inflation, which have now pushed breakevens back to the Trump reflation peak.

Australian inflation markets broadly followed the same pattern but have rightly lagged the most recent move, as the domestic economic picture looks more mixed, in particular relating to the household sector.

So the question is whether or not this is another head fake.

A growing body of evidence suggests inflationary pressures might be building with more persistence this time. For the first time in years we now have synchronised economic growth across the world’s largest economies and importantly, signs of long missing wage growth too.

We noted back in October that Texas Roadhouse Inc. (a large pan-US restaurant chain) guided for 7-8% higher labour costs in 2018 due to rising competition for workers. This was surprising in the context of official statistics indicating US wage inflation of 2.3% at the time. Since then a wide range of American companies, including one of the largest employers (Wal-Mart), have also announced wage increases. While in Europe, Germany’s IG Metall union is pushing for wage increases of 3-4%, which would surprise to the upside vs. ECB expectations. These types of early indicators take time to feed into official economic statistics and are therefore not yet widely reflected in standard narratives.

The prevailing view of low inflation for the foreseeable future has been widespread and entrenched, partly based on anchoring to recent history and partly on reasonable arguments relating to the deflationary impact of globalisation and technology. While the latter may hold in the long run, the information available today is currently pushing the balance toward upside inflation surprise.

If inflationary pressures do indeed accelerate this time, we will see an important paradigm shift for financial markets.

For a long time now we’ve been in a market environment where ‘good inflation’ has been the focus i.e. moderate price increases being viewed as signs of stronger economic growth, which has been positive for asset prices. Transitioning to a ‘bad inflation’ paradigm i.e. fear of inflation overshooting targets due to the accumulated effect of excessive monetary stimulus and impending economic capacity constraints, would be very disruptive to financial markets.

The risk is currently asymmetric because markets are already fully priced for the ‘good inflation’ paradigm and therefore expect a scenario in which central banks tighten policy very gradually and with due consideration for market disruption … i.e. central banks are still friendly.

Inflation surprise is the one thing that can quickly shift market perception of central banks from friendly to hostile, as markets will fear an aggressive policy tightening response to contain the inflation overshoot.

The irony here is obvious. The very thing that markets have been seeking, in order to cement the global economic recovery narrative, – inflation – may well end up being the catalyst for a sharp correction in asset prices.

The risk always remains that something new dampens the inflation dynamic again, which is why relative value positions with favourable asymmetry offer a better way to position around these scenarios than blunt directional bets.

For example, right now the US reflation narrative is being priced inconsistently across different parts of the market. Breakevens are back to the Trump reflation peak of early 2017 but nominal interest rate curves have continued to flatten i.e. the yield differential between long and short dated bonds has compressed.

If new economic data validates higher inflation expectations, at some point this will likely force market expectations of future interest rates higher and therefore cause nominal rate curves to steepen. However, if inflation surprises to the downside again, it’s breakevens rather than nominal curves that have more room to re-price.

These kinds of market pricing inconsistencies offer relative value opportunities with favourable asymmetry – the upside potential is greater than the risk of loss – irrespective of which scenario actually plays out.

Ardea Investment Management