LIBOR In The News Again

LIBOR, like the plumbing in your house, tends to only get attention when something goes wrong.

The last time LIBOR made it to the mainstream media was in the context of interest rate rigging scandals and headlines like these;

“Deutsche Bank fined record $2.5 billion over rate rigging”

– Reuters, April 23rd 2015

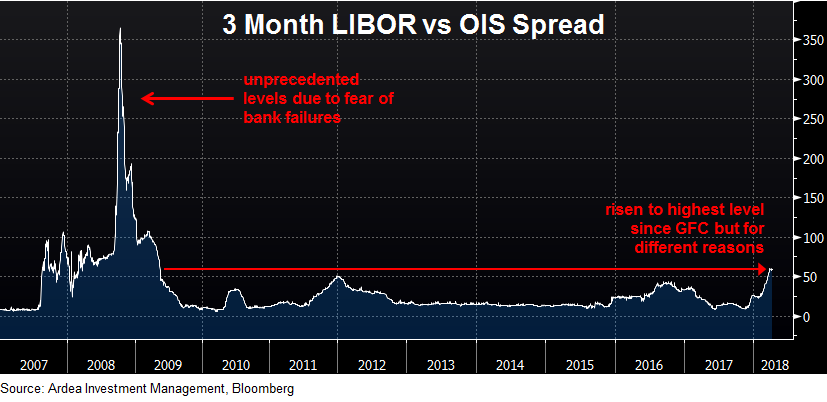

And before that was during the 2008 financial crisis, when fears of bank failures pushed LIBOR to unprecedented levels.

This time around the moves haven’t been as extreme nor the attention so widespread but nonetheless is worth noting for some of its more subtle implications.

Recall that LIBOR can be thought of as the interest rate at which large banks can borrow dollars (or its proxies in other currencies) from each other in the interbank funding markets, and is an important part of the ‘plumbing’ of financial markets.

During the financial crisis this plumbing got blocked as fear of bank failures stopped the flow of funding through interbank markets. While it’s tempting to look at a chart like the one below and draw a direct comparison, this time is different as the creditworthiness of banks is not in question and the funding is still flowing. Rather it’s the price of this liquidity that has increased.

The chart below shows the spread between USD 3 month LIBOR and OIS (a proxy for the FED’s policy rate) and indicates that over the past 2 months the rate at which banks get short term funding has risen a lot more than the FED’s gradual interest rate hikes would suggest.

So, what’s caused the increase this time round?

In our view, it’s symptomatic of the broader theme of tightening USD liquidity conditions caused by the accumulating effects of FED policy tightening and shifting demand/supply dynamics in short term bond markets.

To date the effect of this liquidity tightening has been limited to short end funding markets and therefore has only modest macroeconomic impact. Most household and corporate borrowing is based on longer term interest rates, which haven’t yet been affected by the moves in LIBOR.

A minority of borrowers, for example in the corporate syndicated loan market, may have unhedged rate exposure to LIBOR and will therefore face higher interest payments but this is more an idiosyncratic rather than systemic risk (i.e. a few overly leveraged companies could get into liquidity difficulties).

While the tightening in liquidity is centred in the US, Australian markets are particularly exposed due to the AU banks’ reliance on USD funding markets. Equivalent measures of the LIBOR-OIS spread in AU have moved in tandem with the US, while the EU for example has been unaffected.

Signs of broader contagion to watch for include rising interest rate swap rates, credit spreads and cross currency basis (a proxy for the cost of borrowing USD in FX markets). For now, the weakness in the USD has buffered some of the negative consequences of tightening liquidity, particularly for emerging markets. A stronger dollar, against backdrop of tightening liquidity would cause further pressure.

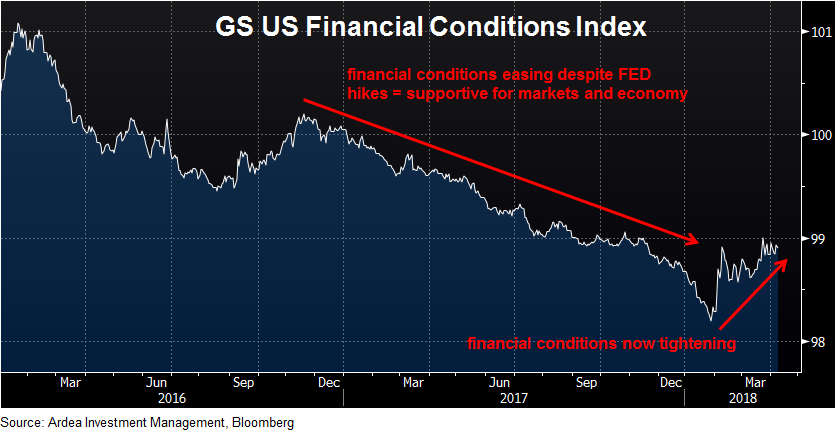

While in isolation, the move in LIBOR is currently not a source of systemic risk, the bigger theme of tightening liquidity is important. To that end it’s worth closely monitoring measures of financial conditions, which account for a broader range of financial variables (beyond central bank policy rates) that can affect economic activity.

While central banks may intend to tighten policy gradually, financial markets can accelerate that process, as reflected in the tightening of financial conditions shown below.

Ardea Investment Management