The Music May Still Be Playing But The Bar Tab Is Running Out

In July 2007, then Citigroup CEO Chuck Prince infamously said “…as long as the music is playing, you’ve got to get up and dance. We’re still dancing.”, and the rest is history.

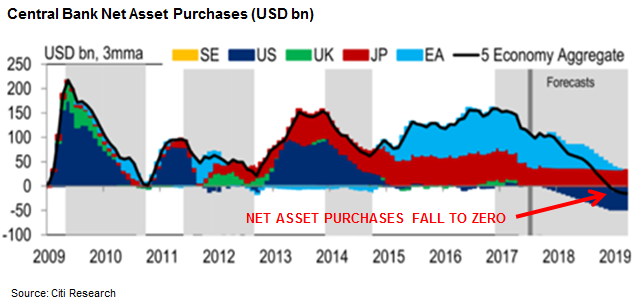

It’s hard to gauge when the music will stop but it looks increasingly likely that 2018 will be the year that the bar tab – central bank asset purchases – finally runs out.

In our August commentary we observed that, given these asset purchase programs were a response to the 2008 recession, since which time global economic conditions have been gradually improving, it would be reasonable to expect that the pace of central bank purchases has been slowing over the past few years. In fact, the opposite has happened and central bank asset purchases have actually accelerated the past few years and in particular 2017.

But now, based on guidance from the FED and nascent murmurings from the ECB, 2018 may be the year this changes and net central bank asset purchases in major economies falls to zero, as the chart below shows.

We also suggested that the constant tailwind of central bank asset purchases (QE) is what has propelled investors to ever greater heights of yield seeking behaviour and as valuations in many asset classes have become increasingly stretched, that tailwind needs to keep getting stronger just to maintain the status quo.

Much like the effects of alcohol, extreme central bank intervention has arguably clouded judgement on risk and asset pricing – near zero interest rates can make any asset look attractive – but 2018 may well be the year that more sober valuation re-asserts itself.

Added to this, the backdrop for monetary policy rates is also shifting. With the FED and BOE leading the way from 2017, consensus forecasts are for a total of seven developed economies to raise interest rates in 2018. This is big shift from the prevailing post-GFC environment in which synchronised global central bank stimulus drove a secular decline in bond yields.

When the bar tab runs out, how long will the party continue?

Ardea Investment Management