The central bank bar tab

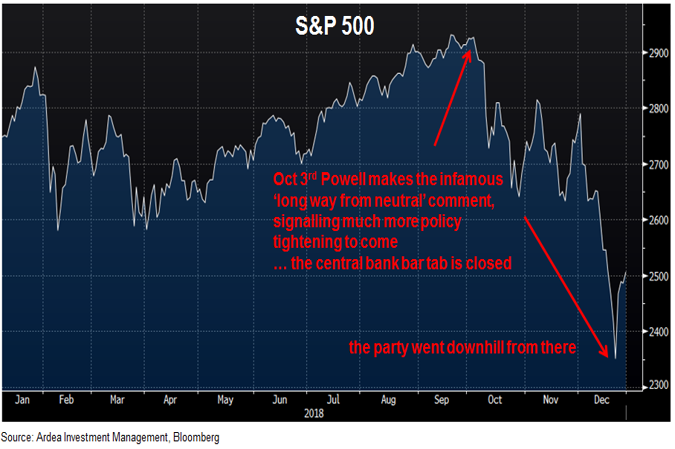

A primary focus for global financial markets in Q4 2018 was the growing fear that the FED has tightened monetary policy too far, too fast and risks tipping the US economy into recession. This culminated in a severe global equity sell-off, which accelerated after the December FED meeting.

Although another rate hike was widely anticipated for this meeting, investors were looking for signs that the FED would then relent and hold off any further policy tightening, in the face of accelerating equity and credit market weakness… but they were disappointed.

While FED Chairman Powell made some attempt to tone down his forward guidance on further policy tightening, it wasn’t enough. The S&P 500 reacted by ending the quarter down 14% and dragged global markets down with it.

Powell’s predecessors also struggled with the art of Fedspeak 1

Looking through the minutiae of Powell’s Fedspeak1, markets interpreted the FED as still seeing economic momentum remaining strong enough to justify further rate hikes and to continue unwinding its program of asset purchases (i.e. Quantitative Easing – QE).

We’ve highlighted previously that the combination of abnormally low interest rates and QE was akin to the bar tab that had kept the markets party going in the post financial crisis era and that it had clouded investor judgement on risk and asset pricing … near zero interest rates can make any asset look attractive. (Refer – The music may still be playing but the bar tab is running out, QE winners become QT losers, Is it really that simple)

And so it was that 2018 goes down as the year when the central bank bar tab finally ran out, causing a more sober evaluation of asset prices to re-assert itself.

It’s not only the fear of a FED induced recession that hurt asset prices this year. Equally important is the fact that investors now actually get paid something to hold cash.

For most of the post financial crisis era the decision to chase growth in equities or yield in credit was heavily skewed by the high opportunity cost of keeping capital in cash at zero rates. With cash returning nothing, pretty much anything else looked good.

But over the past 18 months, as cash rates have risen materially, while expected returns from other asset classes have also declined, that opportunity cost effect weakened, resulting in a reversal of those yield seeking capital flows. (Refer – Interest rates matter a lot, The most important chart you’ve ignored)

These dynamics are central to understanding why equity and credit markets had such a bad year in 2018, despite a backdrop of economic growth, corporate earnings and low default rates that were all positive. (Refer – Just a taste of the volatility to come)

It’s not a coincidence that the S&P 500 went on to fall 19.6% from October 3rd into year-end – its largest drawdown since the 2008 financial crisis – after Powell made the following comments;

“The really extremely accommodative low interest rates that we needed when the economy was quite weak, we don’t need those anymore. They’re not appropriate anymore.

Interest rates are still accommodative, but we’re gradually moving to a place where they will be neutral. We may go past neutral, but we’re a long way from neutral at this point, probably.”

– FED Chairman Powell, October 3rd

Looking forward to 2019, the crucial theme for markets remains the same as it was in 2018 … central bank policy tightening.

And the FED is now in a tougher spot than it was a year ago because the hard economic data is still pointing to solid growth, while the more sentiment based indicators and financial market volatility are pricing in a higher probability of recession.

The big question for 2019 is whether the FED will give in to financial market pressure and hit the pause button on further policy tightening or will they stick to their base case and continue hiking, at the risk of making a recession inducing policy mistake.

And if you’re looking for an early warning indicator of that policy mistake – a financial equivalent of the canary in a coal mine – look to credit markets. (Refer – Credit is the canary)

1 from Wikipedia: “The notion of fed speak originated from the fact that financial markets placed a heavy value on the statements made by Federal Reserve governors, which could in turn lead to a self-fulfilling prophecy. To prevent this, the governors developed a language, termed Fedspeak, in which ambiguous and cautious statements were made to purposefully obscure and detract meaning from the statement.”