The Capital Preservation Characteristics of Ardea IM’s Pure Relative Value Strategy

Financial markets are at an interesting juncture, with equity indices at an all-time high and forecast central bank cuts promising relief to wary fixed income investors. Inflationary pressures are moderating, and fears of a major economic downturn seem to have evaporated. For many, the much-desired Goldilocks scenario appears to be playing out.

However, every major crisis has followed a period of prosperity and while it would be an exaggeration to describe the post-pandemic years in this way, high equity valuations and tight spreads within the corporate bond market point to a degree of optimism that is somewhat at odds with the uncertain times ahead.

The geopolitical environment in particular has the potential to unsettle expensive financial markets, with the ever-present potential for an escalation of conflicts in the Middle East and Ukraine, while President Xi has not hidden the desire to unify China and Taiwan during his time in office. Tensions between North Korea and the US appear to have faded but are undoubtedly simmering in the background. All could be the catalyst to drag foreign nations into a conflict for which there would be very little public support and equally limited fiscal capability.

Perhaps with even greater certainty is the potential for politics to unsettle financial markets in the year ahead, with billions of voters in over 50 countries going to polls in 2024. The US Presidential election in November is undoubtedly the most talked about contest thus far, with former President Donald Trump’s recent conviction for fraud seeming to have little impact on his popularity. However, it will be his foreign policy and plans for immigration that will be most closely watched abroad.

In the United Kingdom, where a general election is scheduled for early July, both the incumbent Tory party and opposition Labour party are facing calls for tax cuts and increased spending which the UK can ill-afford, bringing to mind the disastrous mini budget of September 2022. While in Europe, right leaning and populist political parties have experienced a surge in public support on the back of concerns regarding immigration, the cost of living and the green transition – all of which they suggest are too high and too fast.

Against this backdrop, investors must consider the best way to position their portfolios for a wide variety of outcomes. Should the Goldilocks scenario play out, there is every chance that equity markets will reach even loftier valuations and corporate spreads will remain tight, with the broader fixed income market buoyed by a series of interest rate cuts as inflation continues to moderate. However, should the system be shocked by an unexpected development – geopolitical or otherwise – we will quickly be reminded that the fastest market is a falling market.

It is therefore prudent for investors to consider whether their portfolios are sufficiently robust to deal with a variety of financial market scenarios and the best way to accomplish this goal is to maintain or build an exposure to assets that provide some form of capital preservation or downside protection.

Downside protection can take many forms, with the most obvious being a focus on high quality assets such as government bonds or commodities, including gold. These assets tend to maintain a high degree of liquidity in stressed environments and shield investors from the idiosyncratic risks found in equity and corporate bond markets. However, as we have seen in recent years, the pricing of safe haven assets can be volatile. As such, a more active form of downside protection is worth considering particularly if that exposure also provides the benefit of diversification.

We believe Ardea’s relative value approach to fixed income delivers on all three of these attributes – high quality assets, downside protection and diversification.

Ardea has a uniform objective across our entire suite of absolute return and bond benchmark products, which is to deliver performance that is independent of interest rate moves and general market volatility. This is achieved in part by a focus on high quality government and government related bonds. On average our portfolios do not invest in securities that have a rating lower than single-A and many of our products currently hold only AAA and AA-rated securities. We do not invest in corporate debt. These combined attributes mean that our strategies are highly liquid.

Unlike more traditional fixed income managers, we do not attempt to add value via bets on the direction of interest rates or any other hard to forecast macro-economic variable. Perhaps surprisingly, this macro agnostic approach contributes to our low correlation with other bond funds which typically reflect a consensus view rather than any truly independent or unique market insight.

Our philosophy is that fixed income markets are inefficient and inconsistent pricing between securities with similar risk characteristics is common. These ‘mis-pricings’ are driven by technical factors and the prevalence of large market participants who are not solely focused on profit maximisation – namely central banks, insurers and pension funds. We seek to exploit these inconsistencies via a large number of small uncorrelated trades, none of which are big enough to sway fund performance on their own.

An important process in ensuring our portfolios are risk balanced is stress testing and scenario analysis. Every day we subject our products to over 250 macro and macro-agnostic shocks to test how these funds would have performed during periods of historical stress, such as the UK LDI Crisis or the collapse of Silicon Valley Bank and how extreme moves that we may not have seen before could impact investment returns. Any weakness identified by these tests is addressed by adding new trades or adjusting existing exposures.

Another important aspect of portfolio construction at Ardea is the use of options. These securities provide many advantages for investors; modest upfront cost and known downside when buying options are the most obvious. However, key to the pricing of options is volatility and this means in stressed environments, when the price of riskier investments are falling, option values typically rise. This is an important attribute for investors focussed on capital preservation.

Unlike many of our competitors who use options as some form of tail hedging strategy, options are employed at Ardea to reflect relative value views and are therefore embedded within our portfolios. This means we are not reliant on a large market move to benefit from the downside protection these securities provide.

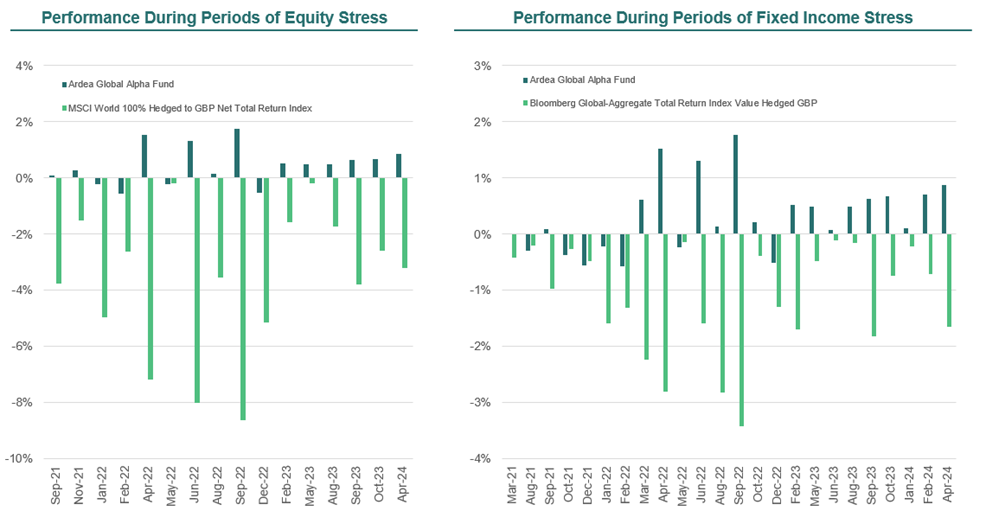

The charts below illustrate the performance of the Ardea Global Alpha Fund in months where either the global equity or global fixed income market has fallen in value and highlight this fund’s successful track record of delivering positive returns when these markets are under pressure.

Source: Ardea Investment Management and Bloomberg. Data is based on the life of the Ardea Global Alpha Fund UCITS (GBP X share class, distributing), 1 March 2021 to 30 April 2024 and is for illustrative purpose only. For Ardea Global Alpha Fund Performance, please click here. Gross returns are calculated before fees and fund expenses and assuming distributions are reinvested. No allowance is made for tax when calculating these figures. These figures refer to the past and past performance is not a reliable indicator of future results. The money invested in the Fund can both increase and decrease in value and it is not certain that you get back all the invested capital. Future returns are not guaranteed.

In addition to highlighting the capital preservation characteristics of the Ardea fund on a standalone basis, these charts also illustrate how the inclusion of Ardea’s relative value strategy in a multi asset portfolio could improve the risk characteristics of that portfolio, especially when placed alongside riskier or more volatile investments.

Indeed, this is the most common use for Ardea’s absolute return and bond benchmark portfolios, to deliver an alternative and uncorrelated source of alpha alongside other riskier investments whilst offering downside protection (capital preservation) in times of stress. Today those riskier investments are most commonly corporate bonds (including high yield debt) and private credit portfolios.

Looking forward it is difficult to predict what the market has instore for investors and Ardea makes no attempt at forecasts of this nature, but our focus on high quality assets, downside protection and diversification means we are confident in the ability of our products to protect investor capital in even the most dire market environment.

Important Information

This document relates to the Ardea Global Alpha Fund, which is a sub-fund of Fidante Partners Liquid Strategies ICAV, and associated strategies (the “Fund”). Ardea Investment Management Pty Ltd ABN 50 132 902 722 AFSL 329 828 is the investment manager of the Fund (the “Manager”) and has approved the contents of this document. In the United Kingdom this document is issued and approved by Fidante Partners Europe Limited (“Fidante UK”). Fidante UK is authorised and regulated by the Financial Conduct Authority in the conduct of investment business in the United Kingdom. In the European Union this document is issued and approved by Fidante Partners AB (“Fidante Sweden”). Fidante Sweden is an investment firm authorised by the Swedish Financial Supervisory Authority (Finansinspektionen). Fidante Sweden is authorised to provide investment advice, reception and transmission of orders and execution of orders on behalf of customers. Fidante UK and Fidante Sweden (Fidante) approve this document on the basis of the accuracy of information provided by the Manager. Fidante are distributors of the Fund and are issuing in this capacity only.

The information and opinions contained in this document are for background purposes only and do not purport to be full or complete. No reliance may be placed for any purpose on the information contained in this document or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document by Fidante or any of its affiliates or any vehicle and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

This document does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or purchase, any shares or any other interests nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefore. Recipients of this document who intend to apply for shares or interests in the Fund are reminded that any such application may be made solely on the basis of the information and opinions contained in the prospectus or other offering document relating thereto, which may be different from the information and opinions contained in this document.

Historical returns are no guarantee of future returns. The money invested in the fund can both increase and decrease in value and it is not certain that you get back all the invested capital. If you are in any doubt about the suitability of investing, you should seek independent advice. There are no entry or exit fees for the Fund.

The value or price of the financial product, as well as the prospectus, documents and KIDs/KIIDs can be obtained free of charge at: https://www.fidante.com/ucits. If you wish to make a complaint, please contact our team at: Complaints-europe@fidante.com.

UK investors only

This document is a financial promotion for the purposes of the Financial Services and Markets Act 2000 (FSMA) and has been issued for the sole purpose of providing information about the Fund. This document is issued in the United Kingdom only to and/or is directed only at persons who are of a kind to whom the Fund may lawfully be promoted by virtue of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (including authorised persons, high net worth companies, high net worth unincorporated associations or partnerships, the trustees of high value trusts and certified sophisticated investors). This document is exempt from the general restriction in Section 21 of FSMA on the communication of invitations or inducements to participate in investment activity on the grounds that it is being issued to and/or directed at only the types of person referred to above. Shares or interests in the Fund are only available to such persons and this document must not be relied or acted upon by any other persons.

European Union

In the European Union and the European Economic Area, this document is available to Professional Clients (as defined under Annex II to Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU).

Fidante Partners Europe Limited

Authorised and regulated by the Financial Conduct Authority. Registered Office: Bridge House, Level 3, 181 Queen Victoria Street, London, EC4V 4EG. Registered in England and Wales No. 4040660.

Fidante Partners AB

An investment firm authorised by the Finansinspektionen. Kungsgatan 8, SE-111 43 Stockholm, Sweden. Registered in Sweden No 559327-5497. The Fidante entities are wholly owned subsidiaries of Challenger Limited, a company listed on the Australian Securities Exchange Limited.