Preparing for volatility: protection strategies for fixed income portfolios

Over the first half of 2014 financial markets experienced a significant decline in bond yields, with a correspondingly strong period of performance. Unusually this was accompanied by similarly strong returns in equities and in other risky asset classes. This runs counter to the much-vaunted negative correlation between returns on growth assets and those on defensive assets.

The causes of this outcome can be traced directly back to the policy settings in force over this period and prior, both globally and here in Australia. While we don’t dispute that quantitative easing and low interest rate settings were necessary to stabilise markets and build confidence, the reality is that such measures do not function as a magic wand which can be waved to permanently increase rates of return on capital. At some point financial returns must fall back in to line with real economic activity, and despite the recent economic recovery globally, activity is still relatively subdued and is below levels that would justify the recent strong returns.

What this translates to, in terms of risk to investment portfolios, is the risk that the positive correlation between bond and equity returns may continue in the event that valuations correct. Such a scenario would involve declining equity prices and at the same time capital losses on bonds from rising yields, and could be triggered by global monetary policy being wound back from its current extremely accommodative levels. The poor performance of both bonds and equities would mean that the growth/defensive strategy embedded in most diversified portfolios would perform very poorly indeed.

This possibility highlights the inability of traditional asset allocation frameworks to deal with a scenario where a single common factor, namely overly stimulatory policy settings, is boosting the valuations on all asset classes. Such asset allocation frameworks rely on the ability to underweight highly valued asset classes, and overweight cheaper ones. This can be difficult to do if the vast majority of asset classes are deemed expensive, due to quantitative easing and low interest rates distorting the pricing of financial risk. Holding cash might be the next logical option, but being underinvested may be not permissible under investment guidelines, or may not be permitted in sufficient scale in order to make a material difference to outcomes.

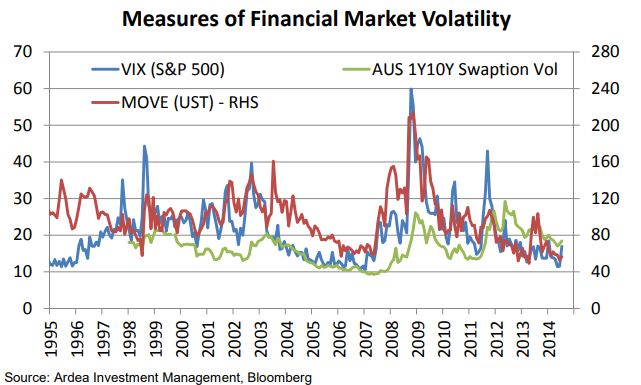

To provide an indication of just how low volatility has become in recent months, the chart above provides comparable volatility measures across a number of key asset classes, including equities in the US (S&P 500), bonds in the US (US Treasuries), and swap rates in Australia (1Y10Y swaptions). All of these measures are at or close to their historical lows.

The question many are of course asking is why is volatility so low? As with most things in financial markets, the answer reflects both macro and micro factors. At the macro level, put simply, central banks both globally and here in Australia have committed to keeping rates either at zero or at their current level, and only raising them in a very gentle and predictable fashion. It’s no surprise that the promise of stability in interest rates has reduced volatility in bond markets, where interest rates are crucial for the valuation of a bond’s cash flows. This commitment has had a similar effect in equity markets, where financing rates remain crucially important for funding company operations as well as future investment programs, and for the discounting of future cash flows as well.

As well as this macro influence, at a more micro level, the net balance of demand and supply in the market for volatility has also made a difference in pushing volatility lower. At a structural level, the supply of volatility is created by the activities of the larger investment banks and commercial banks through their transactions with corporate and retail clients. At a corporate level, demand for structured notes which provide an enhanced yield, provided that markets remain within specified ranges, means that corporates have in effect “sold” volatility to their banker. The bank in turn seeks to on-sell this exposure to the broader market in order to clear the position, creating a supply of volatility to the market.

Similarly, at a retail level, the issuance of investment products which offer a high yield or return provided that, for example, interest rates don’t fall below current levels, or the ASX200 stays above its current index value, result in retail investors also effectively “selling” volatility to the bank offering the product. This is a sale of volatility because endinvestors are negatively affected by these products should markets move by more than anticipated. Again, this volatility is offered in the wholesale market.

Crucially, the significant supply of volatility from corporate and retail products has been met by very little natural demand. In the equities sector, it is common for institutional investors to purchase volatility to protect the value of growth assets such as equity portfolios. However in the fixed income market, the use of volatility to protect defensive asset portfolios appears extremely limited, and we are not aware of any other strategies within the domestic market that are net buyers of volatility for the purpose of hedging existing assets. This excess supply of volatility, combined with very limited demand, has the effect of depressing the price of volatility, thereby creating an extremely favourable entry point for fixed income investors seeking protection against a rise in volatility.

Why is an increase in volatility likely to be damaging as, after all, couldn’t increases in valuations contribute to rising volatility just as much as falling markets could? This is certainly possible, but turns out to be unlikely in practice. Historical experience shows that increases in valuations of almost all financial assets generally involve a gradual and cautious increase, in the form of either rising stock prices or falling bond yields, that takes place over a number of years. In contrast, downward corrections in valuations can occur much more rapidly – for example, it is much easier for stock price valuations to drop by 20% in a week than it is for them to gain 20% in a week. Unfortunately “up by the stairs, down by the elevator” still remains an apt description even of today’s post-GFC financial markets.

Bonds, despite being defensive, fare no better than equities in this respect and are equally exposed to the historical fact that increases in bond yields (i.e. declining valuations) tend to be much sharper than decreases. While the recent flight to quality during the GFC may be an exception, older hands will recall that the sharp increase in bond yields in 1994 was no picnic either. In essence, it seems consistent across all asset classes that the panic for the exits inevitably outpaces the queue for entry at the door.

Strategies to confront an increase in volatility

While the challenges of investing in this environment may seem daunting, especially given the strong performance of both bonds and equities, there are opportunities available to help ensure that a stable investment return can be achieved. Although the current highvaluation, low-volatility environment is creating significant clouds over the outlook for both bonds and equities, the silver lining is that low volatility itself creates a number of attractive opportunities for investors.

This can be achieved in a number of different ways, some more complex than others, but the common factor across all such strategies is that they all involve being “long” or overweight volatility. As a result, should volatility increase in future, the investor benefits from having taken on a strategy during a period when volatility was low or “cheap.”

Consistent with this framework, at Ardea IM we operate fixed income strategies which include being long volatility through the use of options. We are able to build innovative, tailored investment solutions to capture the aforementioned market opportunities. If you would like to discuss these capabilities further please contact us.

Ardea Investment Management