How quickly can you boil a frog? – The case for hedging inflation risk volatility

During the 19th century, several German and American scientists undertook experiments observing the reaction of frogs to slowly heated water. Without exploring the detail of the experiments or the debate over their scientific validity (later scientists questioned just how willing frogs are to sit patiently in pots waiting to be boiled) they spawned the parable about a frog being boiled alive if cold water were heated at a sufficiently slow rate that the frog failed to adjust to its changing circumstances.

The lesson for humans is that we generally have difficulty conceptually recognising and responding appropriately to long-term exponential growth phenomena that occur gradually over time, for example climate change or compound interest (which Einstein reportedly described as the “Eighth Wonder of the World”).

What these experiments didn’t explore was what happens when things change slowly and consistently for a period, but then suddenly and un-expectedly. What would our proverbial frog have done if a teaspoon of hot water had been added to the pot while it was still cold? Would the frog have recognised that the hot water was accelerating an unpleasant process and jumped out or stayed complacent as the hot water dissipated? What about if an ice cube had been added to the water – could that have reinforced the frog’s current ‘cooler for longer’ bias and caused it to lower itself even further into the water?

Metaphors are useful, albeit somewhat overused in financial writing, because they engage the creative centers of the brain to engage with technical topics. At Ardea IM we think about inflation somewhat like the frog parable – it is that persistent and gradual feature of the fiat money system that ‘melts’ the purchasing power of our money over time – the compounding kryptonite to the our compound interest Superman.

But that’s not the end of the story. What our investors really pay us to think about is how to manage sudden changes in the inflation pathway (volatility) over time, which can have significant impacts on their wider portfolios. The pathway in financial markets is often just as important as the end destination, whether that destination is right in front of us or over the horizon. For investors managing drawdowns in capital to fund retirement living standards and maintain spending power it is even more important, as those investors lack the ability to accrue the benefits of compounding as their capital is withdrawn, particularly if this occurs during periods of market volatility.

This paper will explore why the inflation outlook is so benign, why complacency is dangerous, why inflation volatility is a risk that needs to be taken very seriously, and what investors can do about it.

Why is inflation volatility relevant in a world of benign inflation?

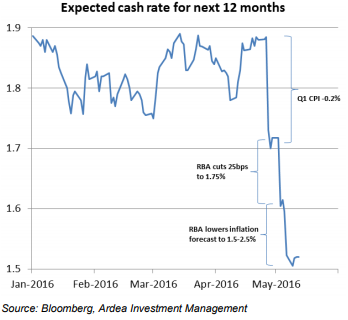

Inflation often doesn’t make the mainstream headlines but it did in May 2016 for the most unusual of reasons – it turned negative briefly in Australia in the March 2016 quarter. The Australian Bureau of Statistics (ABS) announced a negative 0.2% quarterly reading, which was a substantial contributor to the decision by the RBA to cut overnight interest rates in May to a record low of 1.75% p.a. More important than the number itself was that it took markets by surprise, that is, it was unexpected and thus not priced into the markets.

The following graph shows the change that occurred in overnight interest rate swaps (OIS), which is the key historical measure of the market’s 12 month forward expectations of the RBA cash rate , over the course of late April and May.

As you can see, market 12 month interest rate expectations changed by nearly 40bps in the space of two weeks, a large shift in an already flat interest rate environment, which resulted in substantial volatility in Australian bond and currency markets as investors digested this data and adjusted their future expectations accordingly.

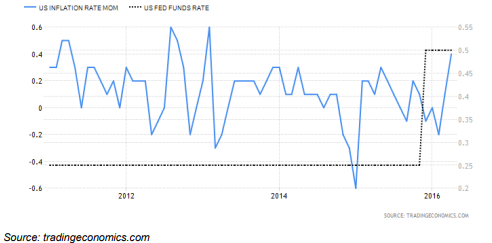

It is instructive to compare this to what is occurring in the United States, where arguably the business cycle is ahead of Australia given the shift to monetary tightening in recent months. The Consumer Price Index in the United States increased 0.40 percent month-over-month in April of 2016. It is the highest rate in three years and above market expectations of 0.3 percent, led by gains in gasoline prices and rents.

What these recent inflation data releases illustrate is the powerful impact of unexpected inflation outcomes on volatility in portfolios, which is amplified in an era of record low and even negative interest rates which have increased the interest rate risk (duration) on many interest rate sensitive assets like fixed rate bonds. The tailwind of falling interest rates has been a considerable positive benefit to asset prices generally over the past few years. However, with the effectiveness of monetary policy and quantitative easing being widely criticized, it is becoming an increasingly mainstream view that this tailwind is abating.

What this highlights to us is that we are entering into a new period of volatility in rate sensitive portfolios where small differences in expectations versus realised outcomes can have larger impacts than periods where global interest rates were much higher and investors had more yield ‘cushion’. Any complacency could be dangerous given that even a modest uptick in price pressures would have a large impact on interest rate sensitive assets.

Investing in 10-year Australian Government nominal debt at a record low yield of 2.22 per cent[1] might make some sense if inflation stays below the RBA’s inflation target of 2-3 per cent over its lifespan, but what if inflation moves back to its traditional range in the next few years? This is a very real issue for investors, particularly those with beneficiaries who are dependent on capital drawdowns and income to live.

What has driven inflation expectations to such lows?

Structural disinflation has been a feature of the global economy since the early 1970s, when US Reserve chairman Paul Volcker shocked bond markets by rapidly raising interest rates in the aftermath of the dissolution of the gold standard to combat record high inflation. This period of high inflation began with the oil price shock brought on by a sharp and deliberate contraction in supply by OPEC but then continued as central banks overused simulative monetary policy to combat the resulting recession. This period of economic stagnation plus monetary inflation led to the term “stagflation”.

Since then, consumers have benefited from the rapid expansion of manufacturing capacity in Asia driving down tradable goods prices, the Green revolution in agricultural technology which has substantially increased global food output, as well as relentless technological advancement which continues to deliver enormous utility to consumers for ever decreasing prices.

We now find ourselves in a global oil price glut caused by those same OPEC producers oversupplying the market to drive marginal American shale oil out of production, anemic employment growth in the US and Europe, and emerging recognition by Chinese leadership that debt-driven and state-led manufacturing and property oversupply is unsustainable. The aging population trend in Japan, Western Europe and China is also a worrying trend for longer term growth expectations. All of these trends have contributed to a global fall in inflation expectations.

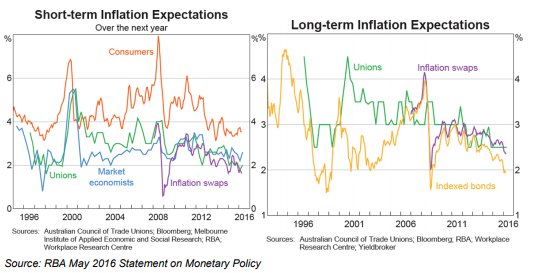

In an Australian context, depressed fuel prices, sluggish wage growth and slowing consumer price survey expectations were a feature of the recent RBA statement on monetary policy2, albeit consumer survey measures are generally highly correlated with petrol prices which we believe are at the bottom of the cycle.

What could cause long-term inflation expectations to rise and what unexpected shocks could eventuate – the case for tail risk hedging

The gradual debasement of a currency’s value over time through expansion of money supply is a known and generally expected outcome of most modern free-floating currencies over the long term. That is, unless you foresee a collapse in the current economic system – in which case gold, tinned food, farm land and firearms manufacturing stocks might be your best bet!

Lacklustre inflation outcomes in recent periods appear to have reshaped investors’ long-term views, with both short term and long term expectations and resultant break-even inflation rates on inflation indexed bonds suggesting that many investors, correctly or not, view subdued inflation as a feature of the global landscape for the foreseeable future.

This logic is hard to dispute at face value, but more sophisticated thinking is necessary. As can be seen from the graphs above, whilst a directional trend is observable with the benefit of hindsight, there is considerable volatility in the pathway.

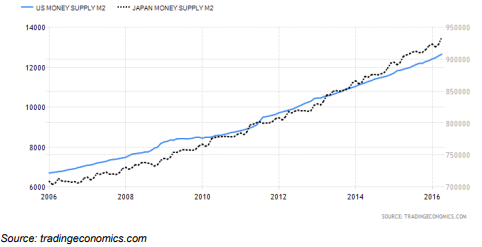

However, we are still witnessing unprecedented global monetary and liquidity policies by central banks in an attempt to stimulate growth. Bank of Japan Governor Kuroda has said as recently as 12 May that they can continue easing ‘substantially’ if needed (in a country that already has negative interest rates) whilst US Congress recently questioned Chairwoman Yellen in February about whether the US could implement negative interest rates like those in Europe and Japan and there remains a disconnect between market interest rate expectations and comments from the US Fed about the pace of monetary tightening[1]. The fact remains that the medium to long term inflationary impact of the last few years of quantitative easing (expansion in the amount of money and credit) in the economy and negative interest rate policy remain unknown.

Unexpected inflation shocks can occur and can have a considerable short-term impact on many asset classes as well as bringing forward the impact of long term compounding declines in the purchasing power of fixed income streams. Furthermore, whilst inflation shocks are nasty in and of themselves, they can often occur in correlation with other equally serious events.

Historically, inflation has been associated with strong demand and thus relatively healthy economic growth, but it is possible for inflation to rise even when growth is weak. This “stagflationary” outcome – poor growth and high inflation – is one where positive returns are extremely difficult to generate as nearly all asset classes perform poorly in this environment.

Inflation has also been historically associated with currency crises, whereby a collapse in the currency, due to say, concerns about economic growth, amplifies the effect of already high inflation. These types of cointegrated events can mean that an inflation problem is not the only challenge for a portfolio to overcome.

Given the widespread consensus that global growth will be flat for some time we do not see any material risk of a short-term inflation breakout. However, economic history tells us that periods of excess money supply growth like we have seen over the past few years globally do give rise to meaningful tail risks of inflation shocks that shouldn’t be ignored, particularly if central banks are limited in their ability to reverse course and raise rates in a world accustomed to cheap credit for fear of derailing economic recovery.

So How Can Investors Respond?

So how should investors think about hard-to-quantify but persistent and compounding risks like inflation?

Traditional responses have been to include non-fiat means of exchange such as gold, commodities, real assets and equities in a portfolio, which are all thought to hedge long term inflation in some way but also provide beneficial exposure to other factors. But these asset classes are more correlated with growth and can be ineffective inflation hedges when stagflationary periods occur and can expose investors to other market risks. For some of these asset classes, this also comes at the expense of low liquidity and high transaction and storage costs.

Most interest rate sensitive securities have some implied future inflation assumption reflected in their pricing on any given day. However, these generally either have a short bias towards it (i.e. will rise in value if inflation expectations and yield curve expectations fall) or have a mismatch between changes in actual inflation and their returns.

For example, fixed rate bonds (comprising the majority of aggregate bond issuance in Australia) will often rise in price if inflation expectations fall as that generally coincides with falling future interest rate expectations which increase the present value of any fixed coupon cash-flows or vice versa with rising inflation expectations. Thus, many investors whose fixed income portfolios are benchmarked to traditional fixed income indices are structurally overweight fixed rate bonds and will find their portfolios are likely to underperform in the event of unexpected rises in both realised inflation as well as inflation expectations.

Therefore, many investors assume holding floating rate bonds will provide an effective hedge as it is generally expected that changes in official cash rates will follow changes in realised inflation. Floating rate instruments thus provide an illusion of hedging, as they reset the rate every quarter or half-year. However the illusion is a subtle one, as with each reset the rates are simply playing catch-up with whatever has transpired. So even if your bond resets every six months, over a five year investment, the bond is still playing catch-up ten times, the cumulative costs of which add up over time. The technical term for the returns on a hedge not offsetting or lagging the returns of the underlying risk being hedged is basis risk.

So unlike our dim-witted frog, anticipation and smart positioning are needed to respond to any sharp unanticipated inflation outcomes, which as the events of May have shown, can and do occur. This is particularly important in many sophisticated investor portfolios which have a structural short-bias to unexpected inflation outcomes.

As such, it is more important than ever to buy insurance against upside volatility in inflation, particularly when that insurance is cheap (i.e. inflation expectations are low) and before it is necessary. The following two breakout boxes illustrate some of the strategies that can be employed to take advantage of these conditions and deliver highly correlated returns to inflation generally as well as periods where inflation surprises on the upside.

Case Study 1 – Structural Long Exposure to Inflation Expectations and Active Management

A starting point for hedging inflation outcomes and seeking to minimise basis risk is to invest in a broader portfolio of securities and derivatives that are indexed to the actual variable creating the positive or negative surprise (in this case, the Consumer Price Index). This creates an effective hedge with minimal basis risk that will perform effectively if inflation shocks do occur. This is a simple strategy that can be effectively implemented by investing in inflation linked bonds (ILBs) or trading between inflation linked and fixed rate nominal bonds if you have sufficient skill to forecast how the difference in yields and therefore prices may change as inflation expectations change.

This yield difference, known as the breakeven inflation rate (BEI), is effectively the rate of inflation that makes investors indifferent between investing in an ILB or a nominal fixed rate bond, and represents a key measure of market forecasts of inflation. What this means is that if an investor buys a 10 year ILB at a BEI of 1.8%, and 10 year inflation expectations change suddenly to 2.0%, then the ILB will realise a gain as the revised expectations are priced in and outperform the nominal bond (remember that the ILB is not expected to have any basis risk to inflation).

Thus, in simple terms, if you believe that expectations will be revised upwards, you might consider buying ILBs and either short (perhaps via bond futures) or just sell your nominal bonds of the same term of maturity and credit risk to capture this value.

Returns can be enhanced further by investing in credit securities that have positive inflation payoff properties or limited risk downside to inflation should investor mandates allow it.

Case Study 2 – Hedging Tail Risk Using Derivatives

An alternative is to build some asymmetry into overall portfolio expected returns that should perform effectively in upward inflation shocks over the medium to longer term, but minimise downside risk in disinflationary periods over the near term – where the majority of fixed income portfolios should structurally perform better as we have outlined above.

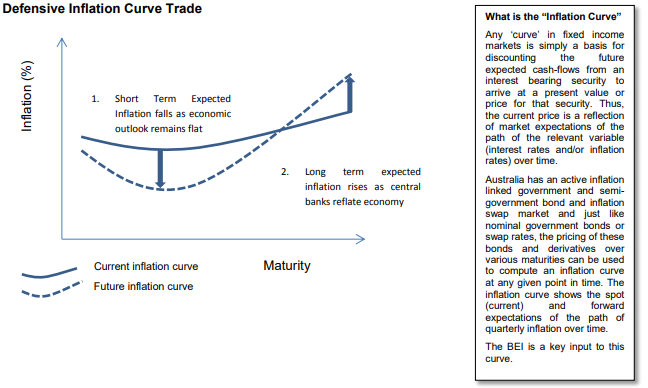

This can be assembled from positioning the portfolio to profit from changes in the shape of the inflation expectations curve. For instance, Ardea IM see low inflation as a feature of the near term but rising inflation in the longer term.

To implement this view, Ardea IM will have a base portfolio of long dated inflation linked bonds that provide positive exposure to rises in inflation over time which will underpin the distributions that investors receive.

However, trading these securities too regularly incurs transaction costs that might erode an investor’s returns. Having regard to this, Ardea IM may take short positions in short-dated inflation linked derivatives such as swaps and options at (3) above whilst simultaneously taking long positions in longer dated inflation linked derivatives that benefit more from (2) above.

Ardea IM may also take some short positions in nominal interest rate derivatives such as government bond futures that benefit from a rising long term interest rate yield curve inherent to rising long-term inflation expectations, which would normally cause regular nominal bonds to decline in value. This trading strategy is designed to hedge some of the structural interest rate risk in the inflation benchmarked portfolio and ensures that the positive exposure to rising long-term inflation is not unduly impacted by rising interest rates.

Conclusion

Investors all too often focus on returns and don’t think about the impact of risk and pathdependency on those returns. Inflation can be thought about in a similar fashion. In this paper, we have challenged investors to think about the risks of inflation volatility on their broader portfolios, despite the long-term cyclical down-trend in current and expected future inflation in markets.

Like the parable of the frog being boiled alive slowly and not noticing until it is too late, we believe inflation presents two core concerns for investors.

The first concern is that inflation is generally positive and compounds through time, even if the rate of change varies. This means that its impact on short term spending power can go unnoticed but over the long term, it has a very significant impact on the purchasing power of investment returns.

To combat this, Ardea IM typically have an allocation to securities such as inflation linked bonds whose returns are directly correlated with inflation in all economic conditions, not just those correlated with positive economic growth scenarios.

The second risk is that sometimes the rate of change can be very sudden, as has occurred recently in Australia and the US. This can have substantial ripple effects on various asset classes as sharp changes in inflation expectations are priced into long-term cash-flow streams and thus the present value of assets.

Ardea IM typically respond to this by ensuring we have exposure to instruments with asymmetric payoff profiles that will not detract significantly from their current portfolio performance (limited downside if inflation stays low) but will respond in an outsized fashion if unexpected inflation volatility or upward shocks occur.

By The Ardea Investment Management Team & Samuel Morris, CFA (Investment Specialist, Fidante Partners)

[1] http://www.bloomberg.com/news/articles/2016-05-15/australian-10-year-yield-drops-to-record-low-on-rba-rate-outlook

[2] http://www.rba.gov.au/publications/smp/2016/may/

[3] http://www.federalreserve.gov/monetarypolicy/fomcminutes20160427.htm