Better ways to position for future inflation surprise

A notable theme over the past few years has been the dramatic flattening of breakeven inflation curves.

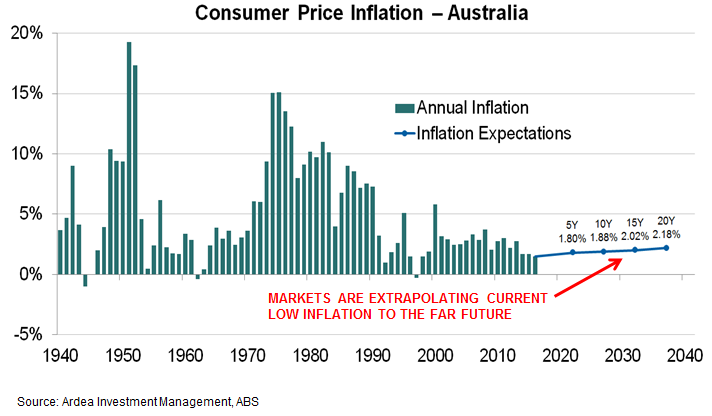

The chart below shows that as realised inflation declined, market expectations of future inflation (as reflected in the pricing of longer dated inflation linked bonds) have also declined dramatically.

So, current market pricing assumes a benign scenario in which the low inflation evident today persists far into the future. Perhaps this may be the case, but the extreme flatness of the breakeven curve shows this scenario is already heavily priced into inflation linked bonds.

Furthermore, the very flat curve suggests markets are currently pricing very little uncertainty about the future path of inflation i.e. the inflation risk premium is extremely low. This means that fixed income investors are not getting well compensated for the risk of future inflation surprises. In fact, various studies have found that inflation risk premia have actually become negative in the US and Europe.

This can be viewed as a market pricing inefficiency driven by skewed market sentiment, distortions created by extreme central bank policies and a behavioural bias for investors to become anchored to present conditions, at the expense of appropriately pricing future uncertainty.

From this perspective, the relative value represented in the longer end of the inflation curve offers attractively priced protection against longer term inflation risks. A more nuanced view of inflation as a multi-dimensional phenomenon that plays out over numerous time horizons, rather than a binary low/high inflation outcome gives rise to a broader range of return generating opportunities to exploit.

For example, rather than simply buying and holding inflation linked bonds outright we can express a view via a relative value curve position. Specifically, buying longer dated inflation linked bonds (where future uncertainty is under-priced) vs. selling shorted dated inflation securities that are more vulnerable to near term inflation weakness, creates an attractive payoff profile. The economics of the position can be further improved by exploiting relative valuation differentials between inflation linked bonds and inflation swaps.

Such a position will profit in a scenario where longer term inflation expectations rise and/or the inflation risk premium returns to a more normal level. Importantly, even if actual inflation in the near term remains low, the position can still generate positive returns as long as future inflation risk premia remain stable or increase from currently extreme levels.

Adding to the attractiveness of these types of positions recent data shows that labour market slack in a growing number of economies continues to decline, thereby increasing pressure for wage growth and ultimately inflation in the future.

Ardea Investment Management