Bank Bill Swap Rate – June update

In April this year we highlighted rising bank bill rates as an indicator of liquidity pressures (refer One measure of Fixed Income risk is at GFC levels – Should investors be worried?).

After moderating since then, bank bill rates have again increased in recent weeks in the lead up to June quarter end. The tightening this time around has been localised to Australia, with US bank rates moderating.

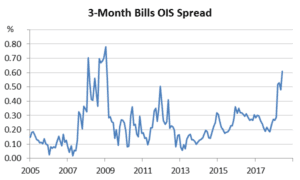

In spread terms, measured over RBA cash rate expectations (OIS), the increase is similar to that seen in 2011 during the European sovereign debt crisis, but falls short of the highs seen during the GFC.

While the pattern of bank bill rates over quarter end has only been observable for the past few quarters, the more persistent quarterly pattern means that banks are more likely to consider passing this increase through to households and companies.

That the banks haven’t done this already can be put down to public opinion, and perhaps the perception that the rise in bank bill rates represents a transition phase as the market adjusts to ongoing regulation and balance sheet constraints.

The banks have also benefited from other factors which have helped offset the rise in funding costs. In particular, banks have reportedly experienced an improvement in the average quality of their loan book, as various regulatory clampdowns have constrained growth in lower quality loans. So while banks may be incurring a narrower interest margin due to higher funding rates, at the same time their loan risk has reduced. This may have negated any urgent need to raise rates to maintain margins.

The ongoing increase in bank bill rates confirms that liquidity pressures remain pervasive in short-term money markets. We expect this will remain a feature of quarterly funding going forward, with the potential for pass through to other funding rates as well.

Tamar Hamlyn

Portfolio Manager, Macroeconomics