Australian Rate Hike Expectations Collapse

The RBA has been signalling for some time now that the next move in rates, when it eventually comes, will be up rather than down. This had also been the consensus view that was reflected in market pricing of future interest rate expectations.

However, as the risks to Australia’s economic growth outlook build – including tighter credit conditions, decelerating employment growth, a weakening housing market, China’s economic slowdown, trade tensions – markets are losing confidence in the RBA’s stated intentions.

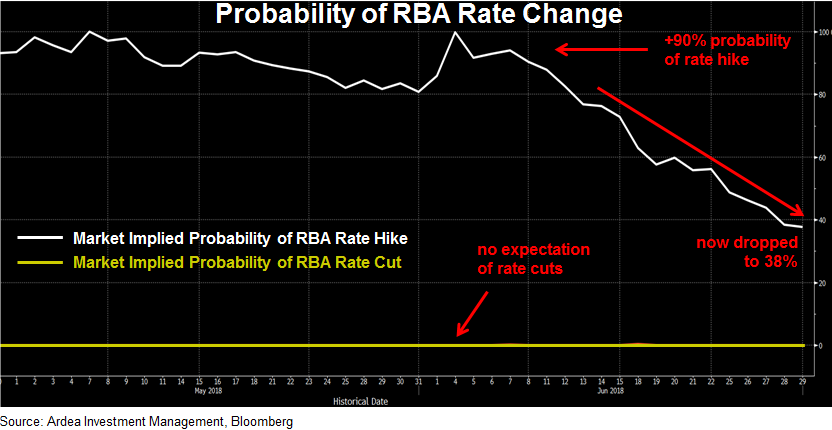

One measure of future rate expectations can be derived from the Overnight Index Swap (OIS) market, which is the tradeable instrument that most closely reflects the RBA’s official cash rate target. By observing the prices at various points on the OIS curve, market expectations for future rate changes can be inferred, as show in the chart below.

For months now the OIS market had been pricing near certainty of a rate hike by June next year but this expectation has now dropped to 38%. So rate markets are pushing back the timing of any future rate hikes, but they are not yet at the point of pricing any possibility of rate cuts.

Now, if the risk factors mentioned above do escalate significantly – a scenario in which Australian equities would be hit hard – it’s likely that markets will shift to start pricing in at least some possibility of rate cuts.

Given that markets are currently ascribing zero probability to this scenario, interest rate derivatives such as OIS and interest rate options, currently offer favourably asymmetric payoff profiles (i.e. small downside vs. disproportionately large upside) to position for these types of tail risks.

Because the consensus is so heavily skewed towards future rate hikes, it’s currently very cheap to take the opposite position as a risk hedge, irrespective of whether that’s the base case or not.

In the event of a major slowdown in China’s economy or escalating domestic housing market weakness, it’s very likely the market consensus will reverse and start pricing at least some probability of rate cuts, making these positions profitable.

Given the growing risks around China, trade wars and domestic housing, any of which could put RBA rate cuts into play, interest rate options currently offer a favourably asymmetric way of profiting from these downside risk scenarios. .

This is not the kind of opportunity that conventional fixed income investments focus on … but it’s a great one nonetheless.